Want A Better Return On Your Money? Use Women Managed Hedge Funds

It’s a dismal fact that women retire with smaller amounts of superannuation than their male counterparts.

Interruptions to their career path usually as a result of taking time out to raise a family further disadvantages a woman who wants to maintain a prosperous lifestyle at retirement.

The reality is that every man or woman is responsible for his/her financial future. Nobody care more about increasing your wealth than you do.

There are hordes of financial advisers out there who do not offer independent financial advice simply because their businesses have been bought out by the major banks and they are obliged to only offer products available through the banks.

It really sucks doesn’t it?

However there is hope; the article below (originally from The New York Times) describes that you’d get a better return on your money when it is managed by a woman.

In the world of hedge funds, a relative few have a woman at the helm. And yet, these funds may be the standouts from the bunch, a new report argues. In the years since the financial crisis, hedge funds managed by women performed better than a broader index that reflects the performance of the industry, according to a report released on Wednesday by the professional services firm Rothstein Kass. The report seeks to show that this “alpha” – superior returns, in Wall Street speak – is no mere fluke. “There is meaningful alpha to be gained from investing in women-owned and -managed funds,” Meredith Jones, a director at Rothstein Kass who wrote the report, said in an interview. “There appear to be both behavioral and biological factors that impact women’s ability to manage money and make them consistent.” From the beginning of 2007 through June 2013 – a period that includes the dark days of the crisis – a Rothstein Kass index of women-run hedge funds returned 6 per cent, the report says. By comparison, the HFRX Global Hedge Fund Index, released by Hedge Fund Research, fell 1.1 per cent during that time, according to the report. Last year through November, the index of women-run funds had a 9.8 per cent return, compared with a 6.13 per cent rise in the broader index, the research showed. (Still, both indexes fell short of the Standard & Poor’s 500-stock index, which rose about 27 per cent during that time.) The report, titled “Women in Alternative Investments: A Marathon, Not a Sprint,” used a group of 82 hedge funds managed or owned by women. Last year, the firm said that female hedge fund managers produced a return of 8.95 per cent through the third quarter of 2012, compared with a 2.69 per cent net return for the broader index. While highlighting the accomplishments of women in hedge funds, private equity and venture capital, this year’s report also draws attention to persistent gender disparities on Wall Street. The research, based on a survey in September and October of 440 senior women in the alternative investments business, suggests that the vast majority of the top jobs are held by men. Of the women surveyed, only 15.5 per cent said their firm was owned or managed by a woman. Among hedge funds in particular, 21.4 per cent were owned or managed by women. About 42 per cent of the respondents said their firm had no general partners who were women. And nearly 40 per cent of the firms included in the survey had no women on their investment committees. In that context, hedge funds run by women remain something of a niche. Some institutional investors, like public pension funds, have a specific mandate to invest a portion of their money in funds run by women or minorities. Though these mandates can be motivated by political factors, Rothstein Kass is seeking to show that investing with women managers can be a wise choice for purely financial reasons. A handful of studies have suggested that women traders behave differently than their male counterparts, acting less impulsively. John Coates, a former trader who is now a research fellow in neuroscience at the University of Cambridge, argued in a 2012 book, “The Hour Between Dog and Wolf,” that testosterone contributed to market swings. Hiring more women on trading floors, he wrote, might have a stabilizing effect. But these ideas are far from mainstream, and the industry has been slow to change. A fourth of investors surveyed by Rothstein Kass said they expected their allocations to women-run funds to increase “somewhat” in 2014, while 2 per cent expected to allocate “significantly” more money. Though the study expected more women to start their own funds in the coming years, the scarcity of such funds is itself an obstacle, a “chicken or the egg” problem, said Kelly Easterling, an audit principal at Rothstein Kass who contributed to the report. “Without a large supply of funds, it’s difficult to achieve appropriate portfolio diversification or, for that matter, put enough money to work to move the performance dial,” she said in a statement quoted in the report. “On the other hand, until there is more money flowing to women-owned and -managed funds, it’s unlikely that there will be a stampede of new fund launches.”

Rhiannon Rees Interview: The Courage To Live An Ordinary Life

I am very blessed to have access to many successful people where I get to ask about their journey to financial success. However, it is not often that I am inspired and amazed at their personal stories to the degree that I was when I spoke with Rhiannon Rees.

She is a business coach, humanitarian, entrepreneur, mother and author of “How to Climb Mount Everest in Sandals-The Courage to Live an Ordinary Life”.

Rhiannon shares her challenges of dealing with childhood abuse, a dysfunctional family, a brother’s suicide, a toxic business partnership, the surprise that comes with finding a cross dressing husband (in her lingerie), and living in a tent with her one year old son when her marriage disintegrated.

Most people would be forgiven for taking the default position of do nothing and be nothing should this have been their circumstances.

What was fascinating was Rhiannon’s mind shift that involved reading over 400 self help and psychology books and Adlerian therapy that dragged her from the precipice to living her dream life. Being ranked 4th Best Business Coach in the World for 2010 by Action Coach is fitting peer recognition.

Listen to what this heart centered entrepreneur with a whole lot of wisdom (and love) has to share.

Should you be inspired by her words and energy and want to know more, head over to http://lovelivingthedream.com/coaching/

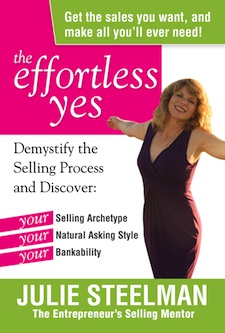

Julie Steelman Interview: Sales is Not a Dirty Word

Julie Steelman knows a thing or two about selling; by choosing to see her sales role as one of giving overwhelming value and service to her clients it has made her debt free and allowed her to retire (at a very young age) to tropical Hawaii.

If you want proof, how about being able to generate $100 million in sales (this is not a typo) from clients such as Apple, Microsoft, Toyota, CBS Sony and Universal Pictures.

And this is when most people are struggling to make commissions and targets.

In her new book “The Effortless Yes: Get the Sales You Want and Make All You’ll Ever Need”, Julie shares her “a ha” moment after the very lean first two years in the business.

Her Road to Damascus moment can be summed up in one sentence, “It’s not about you, it is about the customer”.

Julie Steelman Interview (unlinked)

Julie’s advice: “Get over yourself because it is not personal; you’re here because you have something unique to give that can make someone’s life a lot better”.

Can’t argue with that kind of logic.

So if you have been finding the whole “selling” thing awkward, uncomfortable and downright icky (a technical term in the sales game), do yourself a favor and invest in Julie’s years of wisdom and practical know how-NOW!

Find Julie Steelman at:

http:// www.juliesteelman.com

Dr Xenia Ioannou Interview: Her Inner Journey to Wealth

Dr Xenia Ioannou is a millionaire property investor, businesswoman, wife, mother and author of “Your Inner Journey to Wealth-A Guide to Developing a Millionaire Mindset”.

Together with husband Angelo they founded Alexa Property Group with Real Estate Sales, Property Management, Acquisitions, Research, Education under this extensive company umbrella.

My interest in conducting these interviews has always been to uncover the motivation that spurs a person to become successful. Speaking with Xenia about her own experiences to creating wealth was akin to finding a huge nugget whilst prospecting.

Xenia Ioannou Interview (unlinked)

When a guest so honestly shares the challenges that turn up and more importantly how she overcame these challenges, well that is pure gold.

Xenia’s message is simple, “Take responsibility and don’t be a victim”. Equally important, “Find mentors and associate with like minded people who want to succeed”.

You can’t argue with that direct kind of approach that dare I say harks from her time as a medical research scientist.

Is it paradoxical that someone trained in analytical, scientific evaluation methods can point to an individual’s mindset as the determining factor for success (or not)? Let’s just say that the person most adaptable wins.

What this should mean to you dear reader is that within each and everyone of us is the potential to becoming successful and creating lasting wealth. So, are you ready to step up?

Xenia, to her credit has made it her personal mission to help every person who desires financial freedom by providing the necessary education they did not get at school.

Please go to her website to download Chapter 1 of her book.

Scott and Bethany Palmer Interview: Ask The Money Couple

Scott and Bethany Palmer are best known as “The Money Couple” and authors of “Cents and Sensibility” and “First Comes Love, Then Comes Money”. They are certified financial advisers based in Colorado Springs Colorado and together run Envoy Financial.

Scott and Bethany’s corporate mission statement “Strengthening personal financial relationships” should resonate with anyone who is in a relationship or thinking about going in to and/or getting out of one.

Have you ever noticed that for a commodity that we literally could not do without, serious discussions about money between couples can elicit a range of responses some of which border on the irrational?

Scott and Bethany Palmer Interview. You can download the mp3 recording and pdf transcript of this interview by going to http://yourmoneyandyourmindset.com/online-store/

I asked Scott and Bethany about the dynamics involved in managing joint finances for two people who are about to make a serious commitment to each other. As Scott and Bethany explained “It starts with each person understanding themselves and their personal views on money. These inherent money profiles that we all have determine whether we are savers or spenders, risk takers and everything else in between”.

They go on to say, “Financial infidelity can occur if there isn’t the understanding and clear communication between two people ”.

Got that folks? Talk to your significant other about money, and do it in manner that is non judgmental or accusatory. Personally I think that not taking an interest (no pun intended) in your day to day budget, investments and retirement plan is much like sticking your head in the sand. Wishing someone else will deal with it just does not cut it; you really do not want your assets exposed.

What gladdened my heart was to hear Scott and Bethany supporting parents who want to give their kids a firm financial grounding as early as possible. Therefore, teaching your children to save, invest and respect money will give your kids a tremendous head start. Kids, you will thank your parents for this one day.

As for the sensitive subject of estate planning, Bethany as the mother of two young boys shares her personal story of overcoming breast cancer. Their advice, “Take the emotion out of the decision making process is the first step”, indeed is the most important we all could use.

Find Scott and Bethany Palmer at:

Natalie Ledwell Interview: The Power of Creative Visualization

Natalie Ledwell is a living breathing example that a girl from the small country town of Orange, New South Wales Australia together with a couple of business partners can manifest a $1 million product launch from one simple business idea.

Natalie’s not so secret weapon was “Mind Movies”, a clever piece of software that lets her create and personalize her own dynamic vision board complete with music, affirmations and pictures as the way to realize her goals.

Natalie Ledwell Interview You can download the mp3 recording and pdf transcript of this interview by going to http://yourmoneyandyourmindset.com/online-store/

It was by repeatedly watching her Mind Movie that got Natalie to drop a couple of dress sizes in quick time, and propel her business to one with a multi million dollar turnover, just to name a few of her many goals reached!

In this exclusive interview with Natalie, she dispels the misconceptions about the Law of Attraction and generously shares her personal experiences of how this principle really works.

“If you have a burning passion and desire, and want to help others, situations and circumstances present themselves that will get you to your goals”, says Natalie and “if possible, avoid negative people who don’t understand your aspirations”.

Well, I certainly agree with Natalie on all points.

Find Natalie at:

Natalie is a businesswoman from in Sydney Australia and is based in San Diego CA. She is the Creative Content Director and Founder of Mind Movies LLC. As a motivational speaker, she has shared the stage with luminaries in the personal development field such as Bob Proctor, Joe Vitale and John Assaraf.

Six Steps to Creating a Profit: Interview with Pat Sigmon

It is not very often that I get to talk to a successful entrepreneur and businesswoman can claim to have been in business for 30 years, and in what can be construed even by today’s standards as a male dominated niche.

Patricia Sigmon graduated with a computing degree and founded LPS Consulting Co whose core business is focused on offering businesses computing hardware and software solutions.

Pat is the author of “Six Steps to Creating Profit-A guide for Small and Mid Sized Service Based Businesses”. This is a no nonsense content rich book crammed with straight forward advice for any business owner who knows they need to improve their profit margin.

Listen to the interview Pat Sigmon Interview (unlinked)

She shares how a service oriented company can stay fresh and at the forefront of their clients’ mind and warns that ignoring the internet, social media such as Facebook and Twitter means needlessly leaving a lot of money (read profit) on the table.

Pat explains that every employee in your company is in sales, and that includes the receptionist who answers your phone. As she so aptly puts, “It’s all about sales and marketing”.

If you know your business could do with a make over and a boost to your bottom line, why not get her advice. In these challenging economic times, you will do well to have the expert on your side.

Find Pat Sigmon at

www.DavidAdvisoryGroup.com

www.LPSConsulting.com

Do You Have The Brains, Brawn and Mindset To Be An Entrepreneur: Carol Roth Interview

In these challenging financial times, President Obama is encouraging Americans to lift the economy and restore the stocks of this proud nation by reinventing themselves as the new wave of can do entrepreneurs.

Great if you are cut out for it and have the appetite for calculated risks, a bright idea and the stamina of a marathon runner, but what if you are not and don’t know that.

I suggest you listen to Carol Roth who has sage advice for would be tycoons too in lust with their million dollar idea but have not enough business sense to execute their plans.

Click here to listen Carol Roth Interview (unlinked)

She is an investment banker who used her business strategies to secure more than $1 billion for her clients and complete hundreds of millions of dollars in mergers and acquisitions.

Carol knows a thing or two about this subject and recently authored “The Entrepreneur Equation-Evaluating the Realities, Risks and Rewards of Having Your Own Business” a must read for anyone who is tempted to tell their boss to do the anatomically impossible, quit and assume they can create a fortune from their first business venture.

Carol uses her “Spinach In Your Teeth” method of communication that is both truthful and compassionate to let you know if you have the brains, brawn and mindset for the brief. As painful as it is, the uncomfortable fact for some is that being employed may be the best option for all concerned.

With refreshing candour, Carol encourages women entrepreneurs to acknowledge but not buy into the real or perceived gender divide in the world of big business. She tells with grace and good humour her own experience in this regard when she inadvertently found herself the recipient of the “Best Legs in the Business” award.

Get more information and no nonsense advice on www.CarolRoth.com

Katana Abbott Interview: It’s Never Too Late To Become A Millionaire

If I said to you that a child can grow up in poverty with an abusive stepfather and then at 18 marry a violent man, walk away from that marriage virtually penniless, hit rock bottom physically, mentally and emotionally before coming back as a self made millionaire at 47 years of age, you could be forgiven for thinking this was a Cinderella story of feel good fiction.

Let me introduce you to Katana Abbott, the lady whose life I just described.

I have no doubt that countless women can identify with Katana’s early financial circumstances. However, this is not the point of the exercise because I invite you to listen to my interview with a woman who took action on a number of fronts to change her life.

Katana Abbott Interview You can download the mp3 recording and pdf transcript of this interview by going to http://yourmoneyandyourmindset.com/online-store/

The most obvious was to qualify as a certified financial planner and grow a multi million dollar business. Equally important but not as apparent is Katana’s commitment to becoming a life long student of personal development.

Katana is living proof that when you change your thought and beliefs from can’t to can, positive actions that support your new beliefs pave the way for financial and personal success.

Her concern for the financial futures of Americans entering their golden years prompted her to coin the clever analogy of the “three legged stool” of Social Security, Savings and Pensions as the highly unstable but fundamentally the default option of many peoples’ retirement plan. Know as the Midlife Millionaire Coach, Katana is focused on helping women entrepreneurs, ages 43-65, create financial freedom whilst following their passion.

Her generosity knows no bounds so if you go to http://www.smartwomenscafe.com you will get a free membership to the community and can participate in a free monthly coaching call beginning in April.

And there’s more!

If you go to http://www.Katanaabbott.com you will get her free midlife millionaire success system and for everyone listening to this interview receive Katana’s signature financial organizer planner to get your finances in order.

Ladies and gentleman, you are witnessing the actions of a woman who not only knows that her life has a higher purpose; she lives it.